Posted On: Friday - October 18th 2019 7:26PM MST

In Topics: University Global Financial Stupidity Economics Liberty/Libertarianism

Is it really some kind of crisis? When you compare $1.6 Trillion to the US national debt of $23 Trillion, and maybe 5 x as much as that in Feral Gov't obligations that can't be paid, it does seem like a drop in the bucket. Well, the holders of the US debt are treasury bond holders, and most Americans wouldn't even know whether they are indirectly, or maybe occasionally directly, holders of this form of debt that cannot be paid in full. As the debtors, on the other side, Americans see that the FED can just create more money, and the Congress can just up the deficit. It's been working fine like this for 5 decades, so ...

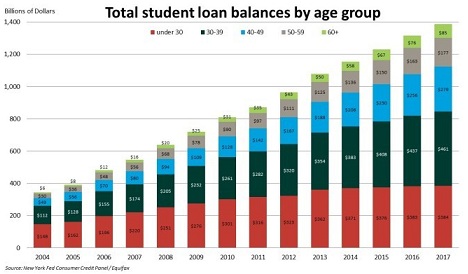

For the student loans, the last-resort holder of the debt is the US Gov't, and again, nobody worries about that either. It's only on the debtor side, as students come of of the Universities with a small mortgage-sized debt load while just entering the working world, that has anybody worried. You can see the numbers, either going up, up, up, or, once you finally get to paying, down very slowly as you pay off an interest accumulating loan.

$1,600,000,000,000 is a lot of money hanging out there, still, and something like 15% of it is in default (with varying definitions of default status). Student loan debt, along with the other consumer debt, is much more real to us than the other, bigger, financial holes America is in. It has also become political, for the blue-squad party of free stuff.

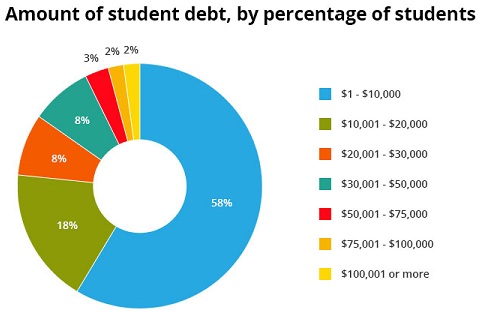

Look at that, well more than half of the loans have less than $10,000 due. We could say also that the median (1/2 above and 1/2 below) loan amount is somewhat under 10 grand (without more data). Either way you put it, what's the problem? The problem is that this chart is for all student loans outstanding, not at all for currently-graduating students in '19 or so. The low amounts due by those 58% are mostly owed by people that have:

a) been dutifully paying off their loans for 5 or 10 years already.

and/or

b) graduated quite a while ago, when tuition was lower and 10 grand might pay 1/2 your bill.

You can play with the numbers in various ways, but the important one, in my opinion, is that steadily growing $1.6 Trillion.

A writer named Steve Penfield has written a very comprehensive article on American student loan debt - Student Debt Cancellation: A Good Idea and a Political Hoax. I really recommend the reader go through the whole thing, as Mr. Penfield does a SUPERB job of discussion all aspects of the student loan problem, with a couple of minor exceptions, one being his conclusion!

I don't want to make this into a review, but I may point out some problems with, and highlights of, the article first, before my own arguments about the conclusion. Mr. Penfield covered a lot of ground, but as he described the financial stupidity of this country, in which we are told debt is a healthy thing, he never drilled down the real root of this particular debt problem - the guaranteeing of student loans by the US government. I've written this sort of thing before, but I'll to explain the moral hazard again: The guaranteeing of the loans means the banks cannot lose. Why wouldn’t they loan $73,000 to a guy who will major in Art History for 5 years … and climbing?

Before the moral hazard of the US Gov. backing the loans, any bank loan officer who made such a move as that loan speculated-on above would be fired. It’s not a good risk. Sure, $5,000 over 4 years to help an electrical engr. student make it through, even back when tuition was $1200 yearly, yeah. That, and loans like it, are a good bet. I see shades of the 11 year-ago mortgage crisis here.

A 2nd minor but very annoying problem with the article is that I suppose stuff doesn't get published* without some little bits of PC SJWisms, so Mr. Penfield had to add his stupid obligatory notes about "institutional racism" and "disparate impact on minorities" out of the blue. That detracts from the quality a little bit.

The author makes a great case for obsolescence of the University system, run as it has been for a century or two, but with the attendance of a large portion of the American population nowadays vs. only the brightest, and I suppose, most elite, back in the past. He lays out other ways of credentialing people for white-collar jobs and other ways of learning, without requiring the huge monetary outlays.

Part of the article is a great Libertarian explanation of the mess America is in due to central banking and the big banks in general. Steve Penfield reads as if he's read or heard a heaping helping of Ron Paul, and he does just as great a job of explaining the financial side of Libertarianism as Dr. Paul could, or, say, Peak Stupidity.

Now, I've gotten this far, the post has gotten long, and I see the need for a 2nd part tomorrow to detail Mr. Penfield's erroneous conclusion, and our explanation on what's wrong with it. Sorry about that. Tomorrow will have the good, ranty stuff. In the meantime, I hope the Peak Stupidity reader will take 1/2 hour to an hour to read the article, as there is lots of great stuff in there.

* I assume Mr. Penfield wrote this long article for other publications, not just the Unz Review. Mr. Unz features all kinds of viewpoints, and would not at all be the type to screen for PC.

*****************************************

[UPDATED 10/19:] Added a bit of discussion of the annular pie chart.

Why make it annular? Is that trending? It's not how you make a pumpkin pie.

*****************************************

Comments: