Posted On: Saturday - October 19th 2019 10:01AM MST

In Topics: University Global Financial Stupidity Economics Liberty/Libertarianism

(continued from previous post)

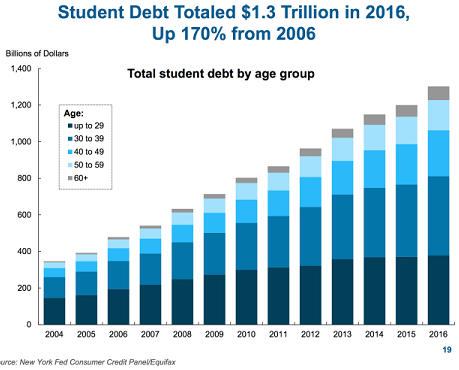

(This is pretty much the same data as on the previous post, but a bit clearer and with only blue shades. I'd already saved this, so ...)

This is discussion of the ideas presented in Steve Penfield's comprehensive article on the whole student loan/traditional university education business - Student Debt Cancellation: A Good Idea and a Political Hoax. Has everyone read it yet? What?? How about at least the Cliff Notes? Anyone? Anyone? Bueller? OK, I can't even ... all right, you all are Peak Stupidity's customers, and the customer is ALWAYS right, and I've got my tenure committee meeting coming, so just stay here and read anyway.

One can see from Mr. Penfield's title what was coming. After that great explanation of the problems, including hard-core Libertarian reasoning, and some good ideas for alternate methods of higher education, what's the guy's conclusion? FORGIVE THE LOANS. Let's have a JUBILEE! Like in the Bible. The author quotes one James Richards, of US News & World Report (they still make that?!) as he explains how the deal ran in Leviticus (excerpt from Mr. Richards, not Mr. Penfield):

The Bible’s book of Leviticus provides that every 50 years all mortgage debt is to be forgiven. This occurrence was called the Jubilee Year. This may seem like a shocking imposition on creditors and a free ride for debtors. Yet, consider the behavioral feedback loops. In the 10th year after the last Jubilee, lenders might lend freely for a 20-year term. By the 45th year it seems likely that long-term credit would have dried up because the lenders were as aware of the coming Jubilee as the debtors. This was a self-regulating system that deleveraged itself before credit bubbles grew out of control and threatened a widespread collapse. It was an orderly deleveraging that seems enlightened in comparison with the disorderly and draconian deleveraging our economy is experiencing today.Yeah, fine, that might have worked, but here's the obvious difference, the both of you knuckleheads: There was prior knowledge of these 50-year jubilees. That makes all the difference in the world! Just as the excerpt says, the money managers of Leviticus-day could plan and make loans accordingly. That is NOT the situation today.

Let me back up a bit and just mention that this student-loan forgiveness business is being bandied about by various members of the Young Turds and Old Pharts of the blue squad. Promising to rob

Steve Penfield's solution to basically just do this this ONE TIME, and then implement an entirely different method of higher-ed, or, at least, financing of it, reminds me of "It's just this one Amnesty, and then we control the border..."* or the Savings & Loan crises of the 1980's, and lastly, and most destructively, the big-bank bailouts of 2008. Beside the fact that the promises to "now go ahead and fix it so this won't happen again" are not usually kept, there is the moral hazard.

Yes, I like that term "moral hazard", and that Steve Penfield, with all his other great Libertarian writing to get to the root of the problem, should really have known what this means. Mr. Penfield writes that those who did the responsible thing, paying off their loans, will at least have learned a lesson that the forgivees will not:

As for the college grads who honorably paid off their school loans, how would granting Debt Forgiveness to other people harm you in any way? If the word “education” has any meaning at all, you’ve gained a great education from the discipline of working, saving and paying off your obligations. Now maybe use those skills to do something even more productive. Unlike the conservative writer Matt Walsh, who worked to pay off his wife’s student debt, there’s no reason to be bitter about “an awful lot of unnecessary sacrifices” made in the past. Look how far that great experience has got you (and him) already?No, I don't think that's the lesson that the average responsible guy, the one who worked in the evenings to help pay at least for the dorm, used his old beater car, if any, and bought the cheap swill instead of going to the brew pubs (you really can't tell anyway after 2!) to keep his loan down to $20,000, instead of $50,000, will learn.

We can’t change the past. And reckless college graduates who are over their head in bills from a worthless degree won’t get a chance to learn from that particular mistake. But they may get a chance to start over. If debt-relieved graduates make the same foolish choices in the future, they will be the ones to suffer.

The actual lessons he will have learned are: Don’t live by the rules anymore, don’t trust the US Gov’t (at least that’s a good thing to learn), and next time, screw the system any way you can!. It screwed you, and who knows what the next thing will be, forgiven mortgages, car loans, CC debt, what? Student loan forgiveness will create even more irresponsibility in a country that already has too much due to 5 decades of hard Socialism.

You think there is a lack of social trust now in America? Wait until more responsible people get screwed, and that’s exactly what your solution is. Don’t try to rationalize it, Steve Penfield.

No matter how much of a scam American higher education is these days, and it's a LOT of one, the fact is that these students and/or their parents signed on the line. Yes, maybe the older "boomer" parents still had the antiquated ideas in their heads about "just get any degree - they'll be white collar jobs just waiting for you", and "hell, I saved for all my tuition, just delivering pizzas during the summers", etc. I know, they were, and still are, deluded about the modern costs and rewards of a BS degree. I would hope these would make up a majority of the cosigners, as they deserve to pay for their inability to keep up! If they didn't sign, but still gave their kids bad advice, well, I guess these kids can learn some truly valuable lessons. Why didn't their baby-boomer parents teach them "don't trust anybody over 30", right? ;-}

Then there are the bogus complaints about "hey, the amount keeps going up, it was just 4 years of grad school." "Then, I didn't borrow any more and took a year off to tour Europe, and it STILL went up!" Yeah, the US Gov’t does lots of criminal things, but accumulation of interest during forbearance (see the difference between forbearance and deferment here) is not criminal nor is accumulation of interest during a decade of non-payment.

Even with all the time spent on the PC, SJW crap, isn't there any time left at college to learn how to use an compound interest table (P, A, F, Rate, etc.)? You can learn this in 10 minutes. These calculators are on-line – don’t tell me modern students don’t know how to “search it up”.

(Of course, 8% versus 10% makes a difference, especially if you don't pay for 10 years.)

What's my solution, or attempt at one? I guess it'll be in Part 3, next week.

* See also 1986 Illegal Amnesty - Ronald Reagan's regrets..

Comments: