Posted On: Thursday - April 9th 2020 11:00AM MST

In Topics: History Liberty/Libertarianism US Feral Government Morning Constitutional Taxes

(Continued from Amendment XI, Amendment XII, Amendment XIII, Amendment XIV, Amendment XV, and Part 1 on Amendment XVI, from yesterday.)

OK, the history and motivations behind the creation of US Constitutional Amendment XVI, permitting a Federal income tax, behind us, let's look at the evil wrought by this 30-word abomination. The interpretation/explanation/history on the Constitution-Center page sums it up pretty well:

In the meantime, the Sixteenth Amendment matters most because it has forever changed the character of the United States government, from a modest central government dependent on consumption taxes and tariffs on imports to the much more powerful, modern government that fought two World Wars and the Cold War with the vast revenue that came from the federal income tax.Well, all 20th century war history arguments aside, they seem to say this like it's a good thing. Maybe that's just my expectation of Statist bias from the experience of ... pretty much living in America the last 25 years, without Ron Paul being the President.

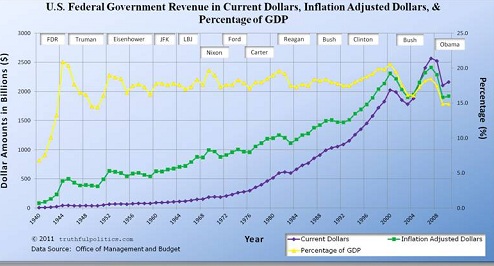

The very first thought of almost anyone on the Liberty side regarding Amendment XVI would be about the tremendous amount of money that Americans are forced to send to the Feral Gov't. It's an order-of-magnitude more in nominal dollars than as recently as 1977 (basic nominal-$ numbers here). I won't trust the BLS numbers on inflation, but if they are going to live by these numbers, it'll show an even worse increase. (BTW, on any of these kinds of sites, you can throw the '20 and '21 numbers right out the window ... assuming it's OK with your local government to open them right now.)

I am sorry I have to reduce the graphs so much to fit this site, but I hope the reader can make it out. In US Gov't-mis-calculated real dollars, it looks like a > 4-fold increase from 1960 to 2010, 50 years of Socialism. Maybe it'd be merely double based on accurate inflation numbers. I wish these graphs were more up-to-date, but one does not have to be a rocket surgery meteorologist to know which way the wind blows [Whaaa? - Ed.].

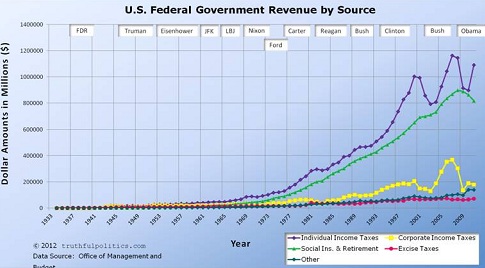

Now, here is a major digression, but because it really should have been part of yesterday's Morning Constitutional, and I just came across the site, here is a VERY informative graph showing Fed-Gov income SOURCES:

The red curve is excise taxes on certain goods manufactured and they have always fit the definition of and indirect tax. Even on the original site, in which one can blow the graphs up, I can barely see where that red curve is, but 10 years back, it was roughly $50 Billion dollars out of a total of $2.3 - $2.5 Trillion. At 2 - 3%, it's almost negligible, while a century ago, excise taxes and tariffs were pretty much how the Federal Gov. was funded. Now that's a big change.

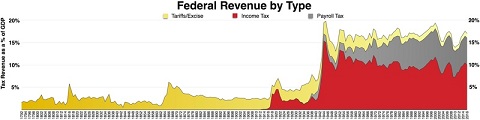

(Keep in mind, those are percentages of GDP.)

(Yellow is tariff/excise tax, reddish-brown is income tax (corporate and personal), and gray is "payroll tax" - they don't want to say "your Social Security and Medicare payments that you'll like never see again".)

Yes, the scale of the money taken from Americans has increased by a massive amount since before the abomination of Amendment XVI, as the Feds tapped into that very lucrative source. It's not the whole of the evil though, by any means.

You know, we WILL get to the subject of the 5 Evils Of Income Tax* at some point, I promise you, as that is really what I'd like to write about. These digressions, though they are pissing off even this writer, are at least increasing our regularity.

* "The 5 Evils of income tax" - does that make me sound like Chairman Mao? Also, does my

Comments: