Posted On: Friday - July 24th 2020 10:28AM MST

In Topics: Humor US Feral Government

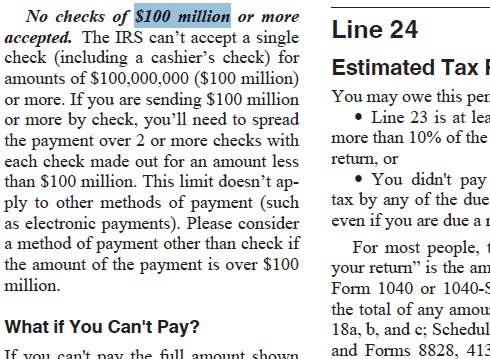

You probably should put in a squiggly line so the IRS can't fill in a few extra hundred dollars for themselves. [There it is! You're welcome. - Ed] Still, I'm sorry, but your check will be declined due to your failure to adequately read the 1040 Instruction packet (in convenient .pdf format). There may be some interest accrued during the correction period, and no, we don't charge the FED discount rate, but our normal 8% ...

I spent a lot of damn money on these people a week ago, so I may as well get something else* out of this income tax business. I was ctrl-f'ing (not the cuss word, the short-cut key) for "check" in the IRS 1040 on-line tax instruction .pdf when I ran into the little gem above. That's right, make sure you don't write any checks for over "Nine hundred and ninety-nine million, nine hundred and ninety-nine thousand, nine hundred and ninety-nine

Does anyone imagine that there are rich guys around who, first of all even look at the IRS 1040 tax instructions, even have accountants that look at the 1040 tax instructions, or, much less, just pay the, let's see, Taxable Income x 37% (0.37) - $35,012.50? (Oh, but if you're married still you can subtract off $61,860. Whew, what a break!) This is the system for the middle class in that .pdf, maybe more like the lower- and middle- middle-class. Check out Peak Stupidity's Americans' attitudes on the income tax for a thorough speculative run-down of the income tax system as it applies to 4 classes of Americans. (I spent a lot of time on that one, so ...)

The tax system set up for the people who actually pay anything in the neighborhood of $100 million is one arranged by the Feral Gov't regulators with the help of the people who end up paying nothing near the neighborhood of $100 million when it's all said and done. The whole thing is an art that requires as much creativity as, you know, one of those guys from the Renaissance. You know, the fancy hotel downtown where the accountants of these money-makers stay.

The people who should be paying $100,000,000 in income tax have accountants who make so much money saving them money that these accountants have their own accountants to do their taxes. Who does those OTHER accountants' taxes, you ask? Listen, I don't kn... it's just ... it's accountants all the way down.

So, please, Mr. IRS publications man, don't try to bullshit me and make us all think that the system is the same for everybody. The middle class gets screwed as is the usual thing these days. That's why I was the one cntr-f'ing around your .pdf looking for information on who to cut a check to, not the guy who is required to cut 2 checks. Maybe you have this text in there to rope in that one occasional naive nouveau rich guy. Good luck with all that.

Most Americans are going to find the next paragraph slightly more relevant: "What if You Can't Pay?"

* We ran into and posted about one interesting tidbit during the tax calculation process before.

Comments:

Adam Smith

Saturday - July 25th 2020 8:02AM MST

PS: Good morning Mr. Moderator...

I'm sure an IRS bill of more than one hundred million dollars is a problem that many 1040 filers have. Most of them probably wire the payment so they don't have to worry about their checks getting lost in the mail.

It's great that whoever wrote that instruction packet had the wisdom to included that invaluable information.

So much winning!

☮

I'm sure an IRS bill of more than one hundred million dollars is a problem that many 1040 filers have. Most of them probably wire the payment so they don't have to worry about their checks getting lost in the mail.

It's great that whoever wrote that instruction packet had the wisdom to included that invaluable information.

So much winning!

☮

#SoMuchWithholding

#edMeInTheAssIn2020