Posted On: Saturday - January 28th 2017 6:39PM MST

In Topics: Music Global Financial Stupidity Economics Southern rock Inflation

This is an interlude within the series of posts entitled "Primer on the state of Global Financial Stupidity (Part __)". In order to properly understand the next in this series of posts about the just-started, on-going financial calamity, the reader must have an understanding of inflation and interest rates and the relation between them.

Just the title of this post is enough to put most readers to sleep, we figure, but this has got to be done - we're slipping it in on a Saturday afternoon when we figure most readers don't have us tuned in (wait, whaaat ?? - Editor). We could always bring Ben Stein back on to liven things up, I guess.

This writer was around and somewhat aware of things already during the high-inflation phase of the 2nd half of the 1970's. My belief at the time was that this inflation was due to some kind of vicious cycle, wherein employees were demanding higher wages to help them keep up with the big increases in prices of food, cars, etc., and that these prices had to be raised in order to pay the employees the new salaries, and round and round. All that had to be done, I figured, was just one party had to give in for a while, and things would become stable. The sorry thing is, is that this is what the newspapers were saying too - hey, I was just a kid and nobody was paying me the big bucks and putting my name in print for these ideas.

The real reasons for the price increases have to do with the increase in the supply of money. The shenanigans of the Federal Reserve bank, the closing of the gold window under Nixon (one could no longer redeem Federal Reserve Notes - read the fine print on your

Let's go back to the late 1970's again. As price inflation was in the lower and even middle teen annual percentage rates, interest rates (mostly mortgages, as credit cards, student loans and even car loans were of a much lower percentage of consumer debt in those days - a good thing) were in the same range. One would think, at first thought, that these should be somehow equal - NOT TRUE. The idea of one party collecting interest for giving another party the use of money for a period of time is based on a natural factor, usually called the "time value of money". The party borrowing could use this money as capital to enable earlier and higher profits than if the money could only be spent as earned by this borrowing party. This is probably all obvious to our erudite readers, but please pick your heads up off the desk anyway. Interest rates should therefore be HIGHER than the inflation rate by whatever the time value of money is. (There's another factor in any debt that has a risk of default to it - the lender should get some extra just to cover the small possibility of the borrower reneging.)

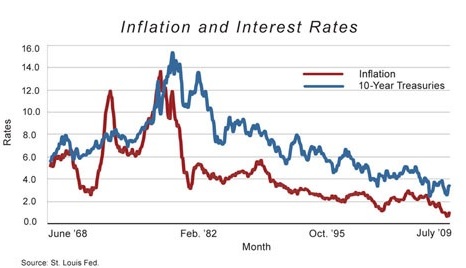

Now, let's ACTUALLY go back to the 1970's again, as I didn't in the last paragraph - even though the presidency of Ronald Reagan reaped the benefits of a large drop of the inflation rate by the earlier 1980's, people arguably* credit that to Mr. Paul Volcker of the Fed. Reserve, who President Jimmy Carter appointed near the end of his term. He got the Federal Reserve banking system to force the interest rates up to very high levels. Note the blue curve of the graph peaking at 15% around 1980 (yes, I also wish an engineer had made the graph). This shows 10-year treasury bonds as an example, but house mortgage could be at 18% in those years. Right now, people are perturbed about getting up toward 4%! The reason the inflation decreased drastically is due to the effect of the rates on economic decisions by businesses, but the FED should not have been involved in the first place.

It so happens that this graph ends at about 2009. There is a lot to write about regarding just about that time, as the FED forced rates very low and has kept them artificially down ever since. This is more of their big interference in the market and it hurts responsible people. More about that later, but it leads to the conclusion of this post.

In a free market of money - meaning no Federal Reserve deciding on interest rates and creating money out of no labor at all - we could say two important things:

1) About interest rates - the time value of money, as measured by people and (mostly) business that borrow or lend, based on their experiences and with their livelihoods dependent on it, will be at the "correct" level, not some arbitrary one set by a Bank (one that keeps people under the impression it's part of the US Gov't - it's NOT). What's correct? What's the correct price of a 2010 Toyota Rav-IV with 125,000 miles and certain specified options, cracked dash, new tires/alignment and a roof rack? Whatever the guy ends up paying the other guy, that's the correct price for both of them. What's the correct price of a

2) About inflation - there is absolutely no reason there should be some steady inflation of prices at even 1% each year, as the Federal Reserve banksters and gov't officials would have us believe. Back a century ago, before the Federal Reserve, it was indeed the case that over the long-term, say, a life-time, there was no steady inflation that would eat away a savings down to 5% of what one started with (keep compounding in mind!).

This stuff is not something most people think about, and this writer would also have had a hard time with it even 10 years back. That's a real shame, as it is also stuff that explains how governments of all sorts have (mostly unintentionally) screwed over their citizens or subjects out of their labor throughout history. Nowadays, it seems to be part of their basic operation to encourage irresponsibility and punish responsibility, raising the stupidity level SKY HIGH:

This is some really obscure stuff above, from an almost-forgotten great Southern Rock band, the Atlanta Rhythm Section - more on them later from this great live album that you can't find.

*Because, arguably, plenty of people will argue about damn near anything!

Comments: