Posted On: Thursday - February 2nd 2017 8:39AM MST

In Topics: Global Financial Stupidity

It's been over a week since any writing here about the financial crash coming, the basic info about which has been written in 4 posts ( previous one - Part 4 - here ) under the Topic Key Global Financial Stupidity.

To continue now, from here, first I want to try to explain why there REALLY is a problem; it's not just the same old talk you've heard since the Reagan administration. Also, for this purpose, and as briefly mentioned in the first of these posts, we have just focused on US Feral Gov't debt and nothing else so far. We will remedy that in Part 6.

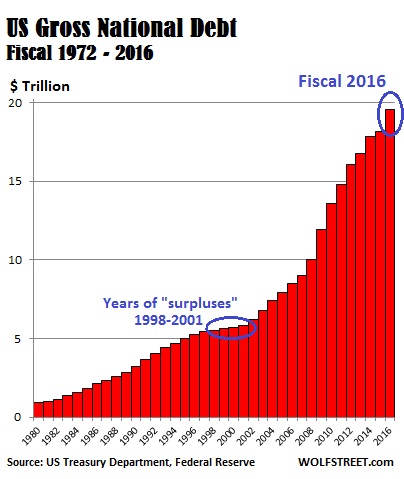

Anyone who has kept up with US gov't news, political debates, etc. for a long length of time may be very jaded and/or just plain bored with the talk about "national debt", "crisis coming", "crisis narrowly averted", etc. Sure, the numbers have been big for a long time, and nothing bad has happened - who cares if the money never gets paid back, whatever. This is understandable, as one may figure this is just as much a "boy who cried wolf" scenario as the Global Climate DisruptionTM scam, which, indeed, IS. Listen, though, a national debt of hundreds of billions of dollars up through the 1970's, then less than 2 1/2 trillion though the 1980's is not in the same order of magnitude as the 20 trillion dollars

now. Look at the graph - please ignore the commentary in blue - not from PeakStupidity, but could be discussed later.

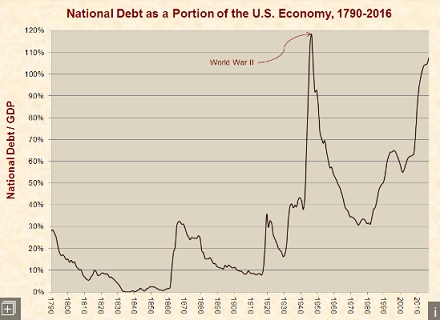

Yes, there's been inflation (a lot more than the US Gov't wants to admit), but not an order of magnitude since the late 1980's, possibly actual values of 150 - 300 % price increases (1.5X to 3X) on goods and services, and varying widely. That's not an order of magnitude, which means 10X. The following graph shows this debt as a ratio to the nations GDP, formerly GNP, which not just divides out the inflation, but factors for a bigger economy, etc.

Right now, the problem is that the debt is not only large, but the 1st derivative, or slope, is pretty high - there are large increases each year. (Just for the record, it doesn't look like an increasing 1st derivative, meaning it can't be exponential - we kinda wish non-math people would quit using this word exponential wrongly - just quit it!) Anyway, the increase each year is the amount of spending minus the gov't theft of money from American taxpayers. The increase - called the "yearly deficit" also equals the yearly additional borrowing, which may really be in the form of creation of money by the Federal Reserve in collusion with the US Treasury Dept. This creation of money puts additional debt onto the books - no you taxpayers never see this money, unless you've got your money in US Treasuries, like a damn fool.

Let's go back to the $200,000 number, the apportionment of this debt per taxpaying household from the first of this series again. We just figured, even on a 20 year payment plan, that would satisfy bondholders if really complied with; that's 10 Grand a year of extra taxation - not possible! What if we could just stem the flow of the red ink, i.e. just stop the shortfall - make the deficit zero, to give people confidence that that 20 Trillion bucks could then eventually be eaten away by slow steady inflation that erodes the hell out of any responsible people's savings. The yearly deficits are running around a trillion dollars so the math comes down to that same $10,000/year figure - so again - not possible!.

Comments: