Posted On: Saturday - January 9th 2021 6:23PM MST

In Topics: China Economics The Future

Yesterday's Part 1 of this series was an introduction to what I think could happen as the US goes more into financial ruin, and China has the dollars for looting. I want to add one thing in answer to commenter Alarmist, as he noted that the same fears were present in the 1980s as Japan had been building up a big trade surplus with America.

From that 3rd "a lot of ruin in a nation post again:

Hey, it [the Japanese conquest of a big portion of the US auto market] WAS worrisome, and tensions were sometimes high (see the 1986 humorous feel-good movie Gung Ho - not even a Japanese expression, it's Chinese! -with a young Michael Keaton). I mean, they Japs bought Rockefella Center for cryin' out loud! OMG! Well, this all faded when the Japanese stock market collapsed like many paper/computer types of wealth do. Japan still has a large economy and we all know they have kept up the high-quality and heavy-duty manufacturing as opposed to Americans.SNIP

That's ancient recent history; let's discuss China here. The country's population is an order of magnitude larger than Japan's, and 1/2 order of magnitude larger than ours, so when they do get economically powerful, things are DIFFERENT, as I said. The 2nd factor of big numbers mentioned above it that, though the Japanese grew economically mighty by the late 1980's our economy was multiple times bigger AND we still manufactured a majority of American-bought consumer and industrial goods. The situation is completely different now, and we don't have our economic/manufacturing base of even 1995 left.

Let me just respond against a couple of general arguments. "Yeah, well, that's what they said about Japan." Besides the order-of-magnitude larger problem there is this time, as already explained, are there any signs that the Chinese economy will just fold, and that ours will get right back on it's feet? I don't see it.I wrote that > 3 years back, and China's economy is growing even more quickly, as ours has been devastated more quickly than expected with the Kung Flu PanicFest LOCKDOWNS. China has 10 X the population of Japan. Their economy is bigger than ours. (I don't trust GDP numbers, neither our BLS ones nor the CCP's numbers, but they are beating us in almost every kind of market - the amount of air travel going on there is amazing!)

Now, on to housing. Note that the city of Seattle, Washington* is one that we have mentioned as having lots of foreign investment, causing problems for regular Americans who just want to, like, live there. It has been the same story in other West Coast cities, San Francisco, Los Angeles, and Vancouver, BC, Canada (now called Hongcouver, and yeah, not our problem).

From my Chinese sources, I've learned that the Chinese people that come here to purchase these nice houses all over these cities (along with in university towns all over) are not the Jack Ma's. There aren't enough of the entrepreneurial rich, as good as the economy is doing. No, China still has a very non-meritocratic system, contrary to what unz writers will tell you, when it comes to the big money. It's corrupt officials at all levels of government, members of the CCP, that have the money for the houses on the hills of San Francisco and Seattle. The buyers below may be from a Chinese family whose breadwinner father makes $600 monthly. "Man, how are you gonna make the payments for this place?!" Guy puts his arm around your shoulder. "Got one word for you, for your future, Ben ... bribery."

It's corrupt money, graft, bribery, whatever you call it, taken from the much greater number of actual hard-working Chinese people and non-State-owned factory owners that makes these $600/month Chinamen into Capitol Hill homeowners. As we noted in some of those previous posts on this topic, the idea is to get that money the hell out of China, for when/if another round of anti-corruption campaigns happens. See, those campaigns are righteous and just when YOU run 'em, to punish your CCP enemies, but watch out for that Karma. Get the money out, send a child to an American university, have a wife and anchor baby pre-bugged-out in that nice place, for when you just got to get out. After all, China is corrupt as hell, and you don't want to spend the rest of your life there, right?

With those piles of money ready to bid on these investment/bug-out places, it only takes some tens of thousands or a hundred thousand Chinamen to change the market. The American middle class, or what's left of it, will be left living in apartments, commuting from far out, or leaving these beautiful West Coast cities. "Affordable Family Formation" is a term Steve Sailer uses a lot, one he may have coined, and it's an important idea. Being able to afford an actual detached house is a big part of this. Sure, kids grow up in Manhattan in apartments, and a few in some big cities, but parents want safe play areas and privacy for their kids.

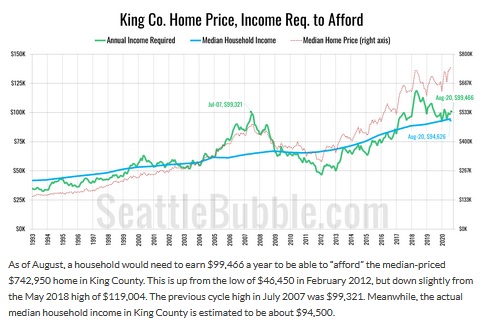

The graph below from the Seattle Bubble site is fairly current, or as current as The Tim gets, from summer 2020.** Note that the blogger defines "affordable" at what a median price house costs, but his left axis represents the income required to make payments at today's LOW interest rates. Better buy now, right?!

(The big increments are $25,000 income, and because the guy let the software break up the $800,000 in house cost into the same 6 increments, they are $133,300 each - hard to read here, I know)

For a family with household income of just under $100,000 to buy that just under 3/4 million dollar house, it'd be tight. Even with a reasonable property tax rate, I can't see the payment being under $4,500 monthly on a 3.5% loan, after some small down payment. Geeze, after taxes (though WA does not have income tax - for now), the family will take home maybe $6,500 monthly and $4,500 goes to that median "affordable" house! That's not your father's affordable living, I can tell you.

From this site, I found that there are ~133,000 detached housing units in the city of Seattle.*** That's just in the city, but it's all I got. Now, take a Trillion bucks to be spent by Chinese investors on housing (the rest for other goodies like manufacturing plants and farmland). That's coincidentally right at 10 X all of that housing in the Seattle city limits at the median price****, as in, all of the detached houses. Take 10 Seattles, and since Chinese people like living in the city, they can buy up 10 whole cities of housing.

What I'm getting at is that $1,000,000,000,000 is a LOT of money, even when compared to big city real estate. NY City is an exception. We're still saving it for looting by the Japanese, when they ever get their shit together again.

I suppose you might not call this looting as of yet. We ought to have laws that prevent foreign ownership of property at all, but then, as we'll discuss regarding other assets, there are always ways to do it. Wait until Americans are poorer than they are now and the dollar goes down the toilet. We'll see what looting looks like. Anyway, the realtors don't care:

PS: Seattle in particular also has the big money from the stock options of the Amazon/MS/etc. crowd.

* I ended up with the picture up top (on these posts) due to a search for images relating to Seattle. I'd kept up with the housing market there just out of interest during the bubble years, on a site called Seattle Bubble. A guy who calls himself "The Tim" has been running that blog since a few years before the '07 crash, and I had started reading it in '05. You gotta put some credence in a guy who used that URL early in the 00's decade. The graphic below is from the site, and I will change to the housing bubble (2.0) topic again in a post to come, again using The Tim's data and very nice graphs.

** He's slowed down in posting a lot from his heyday before, during, and for a few years after, the housing price crash of '07. This data is for all of King County, which includes Seattle, but spreads far and wide. E-W, it's from the crest of the Cascades -Snoqualmie Pass - to the Puget Sound, and N-S, it's from Kingston and just N of Lake Washington to Federal Way, just NE of Tacoma.)

*** Believe it or not, I had estimated 125,000 based on a really rough calculation: 3/4 of a million people, 1/2 a million live in detached houses, and average 4 to a household. It was just luck.

**** I know that median is not the mean. If we had the mean price of detached houses, than that calculation would be more accurate. We're just ballparking it here - bear with us.

Comments:

Sgt. Joe Friday

Monday - January 11th 2021 10:55AM MST

PS My wife and I toured an open house one afternoon a couple of years ago in our old neighborhood. As we were entering, an Asian couple were leaving with their (not surprisingly, Asian) agent. They could not have been any older than 22 or 23, generally not the type of buyer you see looking at homes in the $800K - $1M ballpark. I said something or other to the listing agent about how young the couple seemed, and he remarked that the couple did not have any money, the parents were buying the house for cash in order to have a safe place for at least "some" of their money.

The Alarmist

Sunday - January 10th 2021 8:06AM MST

PS

@Mr. Moderator said, “It's corrupt officials at all levels of government, members of the CCP, that have the money for the houses on the hills of San Francisco and Seattle.”

Now I don’t feel so bad that local officials are letting these two former gems of cities turn quickly into shitholes. Our criminal elite will be able to buy back in at bargain prices, having already unloaded to the ChiComs at the peak of the market.

Ka Chink !!!

@Mr. Moderator said, “It's corrupt officials at all levels of government, members of the CCP, that have the money for the houses on the hills of San Francisco and Seattle.”

Now I don’t feel so bad that local officials are letting these two former gems of cities turn quickly into shitholes. Our criminal elite will be able to buy back in at bargain prices, having already unloaded to the ChiComs at the peak of the market.

Ka Chink !!!

Ganderson

Sunday - January 10th 2021 8:04AM MST

PS. Man he was glad he found her...

One of my favorite Rod Stewart songs.

One of my favorite Rod Stewart songs.

Moderator

Saturday - January 9th 2021 11:35PM MST

PS: She's a cutie. Sound like the type that would bite your neck, up on deck ...old Rod Stewart song.

Ganderson

Saturday - January 9th 2021 8:51PM MST

PS were I not happily married I would be interested in May Lee