Posted On: Saturday - August 5th 2023 8:16AM MST

In Topics: US Feral Government Dead/Ex- Presidents Taxes

This was to be part of the previous post, but it was already too long. This image below is of another graphic that appears yearly in the IRS 1040 Instruction book .pdfs. This one is in there one page prior (107):

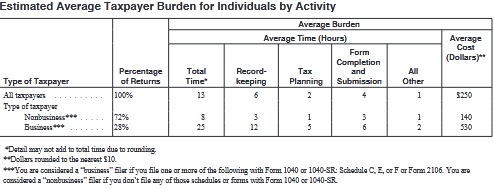

In case it's hard to read, this is the "Estimated Average Taxpayer Burden for Individuals by Activity". Haha, well, doing the taxes is not exactly what makes us beasts of burden owned by the IRS. It's the money - though that's only #2 in the top-5 list of the evils of the Feral Income Tax, per Part 3 on Amendment XVI, in our Peak Constitutional Amendment series.

We've done this post before, in '22 - Peak Stupidity beats national time-wasting averages.

In that previous post I mentioned that this tax-burden information is something that came out of the Reagan Administration, I'm pretty sure. Old Ronnie really did want to cut government, whether people today believe that or not. What those people might want to "search up" is that President Reagan dealt with a D-controlled Congress the whole 8 years, so it's not like he could actually implement everything he wanted.

I remember that President Reagan was bent on simplifying the Income Tax system, if he couldn't eliminate it. A little bit changed for the better on the former, and the latter was of course out of the question. Reagan also wanted Feral regulation paperwork in general cut, especially as it burdened the individual or small business. Hence, this chart, as at least now we know how much of our time this paperwork is to take. (Well, nobody figured on the internet. Turbotax, though, had started up in 1984.)

I see that I, were I average, per the IRS, I am supposed to have spent 3 hours completing the forms, but also another 5 hours on other tasks, planning and record-keeping. Nah, the plan is to get this crap done sometime in mid-April as quickly as I can. The record-keeping is shove all the stuff the comes in late January into a file in a drawer.

Then, I delegate the paperwork to the kid.. [Wipes hands of whole matter.]

Then, he screws up 2 things on the State form, so I re-delegate the paperwork in the form of an amended return.

Interestingly, the 2 numbers in that previous post (from the Washington Examiner), average time spent, and opportunity cost, are way different from what the IRS says. For the average of all taxpayers - gotta assume they're not counting Big Biz corps - the IRS says 13 hrs, of work, while the W.E. study says 24.9 hrs. The IRS says $250 in opportunity cost, while the W.E. study says $800. Note the income the IRS takes as average: $19/hr. The W.E. study uses $32/hr. The IRS ought to know average income, right? Or is it that nobody has updated this table in years. That's probably the case.

The IRS 1040 Instruction booklet: Bring it to the beach this Labor Day weekend. Two thumbs up!

Comments:

Moderator

Sunday - August 6th 2023 4:21PM MST

PS: If it got complicated, as it may have for you with deductible expenses of various sources, I might have too, Mr. Blanc. It would irk me to no end, still, to pay out even more money to tell the IRS how much I owe.

MBlanc46

Sunday - August 6th 2023 8:57AM MST

PS When I started receiving freelance income in 1990, I decided it was time to outsource tax preparation to a tax accountant. I’ve never looked back.