Posted On: Tuesday - September 30th 2025 7:03PM MST

In Topics: Music Preppers and Prepping Economics The Future Big-Biz Stupidity Inflation

Peak Stupidity will veer towards something different today. We try to keep our readers on their toes.

There are 2 different attempts at financial planning, like for the future and all, that we'll use for illustration of the same point -

Now THAT'S some financial diversity!

The Big Biz company that employed me was growing fast, and there opportunities for employees to make boo-koo (is that how you spell it?) bucks from stock options. There were a whole lot of young people working there who really knew squat all about the stock market, interest, taxes, spelling, any of that. Well, they knew a lot about tattoos, hair coloring, and attaching pieces of metal and other materials to their bodies and faces, so who am I to criticize one weak spot...?

The company nicely hired some small group of financial experts to hold a "boot camp" - I believe that was the term in vogue then for a long training meeting - about how to get the most out of one's stocks and options, during work hours. Hell, why not? I sat through an hour and a half or so of "for the tax bracket you're in, you should hold x% for the longer term", "the optimum gain will result from exercising these options in the next fiscal... something." It made reasonable sense, but then, it depends.

It depended on one big thing, so I raised my hand. "Let me ask you something. This whole thing has to be based on some estimate of the change in the stock price, right? What do you all assume?" "10%... a 10% annual increase."

I shouldn't have been, but I was shocked. This was not IBM or General Electric. The stock had gone up 400% that year, it did go down to by 90% or so a couple of years later, then way, way up long afterwards, so what the...? The whole talk was garbage due to it being based on an assumption that was very likely to NOT ever be the case. OK, well, no reason to make a fuss. I said "OK". I already knew that this type of planning was no good for the situation, but those other people in there... well, not my job....

"But, but, I was led to believe there would be no National ID number..."

Now, I'll discuss the same idea for the case of financial planning for something the large majority of Americans have been signed up for. That'd be the The Social Security Scam, errr, Scheme(?).* I've got people who are getting close to being on the receiving end for some of that sweet, sweet, cash... that I have never, ever, counted on for my future. (I think of it as just another part of the Fed Income Tax, a pretty significant 6 1/2% too.)

You can start getting checks at 62 y/o, I think, or you can wait until 65 or even later. Those checks will each be (nominally, a key point!) larger if you start collecting later. Ahhh, what fun for an accounting, statistical, or actuarial type! Let's determine what will get you the most money out of

I would like to raise my hand, but among friends and/or family, I don't have to. I could bring up that there are a couple of assumptions that are just taken as a give here:

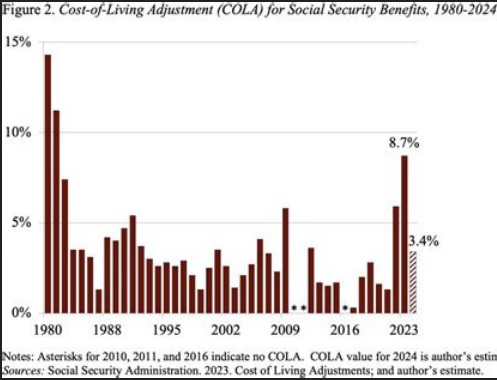

1) Inflation is not a factor, whatever it does, because, remember, SS payments are INDEXED! Yea! (The COLA - Cost Of Living Adjustments - started in the mid 1970s for (damn good) reasons.) I'm sorry, but I don't believe they are CORRECTLY indexed.

The chart looks more reasonable than I'd expected. However, that whole last 20 years, even with the 6% in '09 and the 6% and 8.5% Brandon years, is not what I've experienced. Generally, in all many Inflation calculation posts, I end up with 4.5 - 5.5% while I'm seeing a 35 year average of 2.7%*** This is not peanuts - again, see **.

If we took the actual inflation rate from, say Shadow Stats as a potential SS recipient, you may want to change your plan a tad.

2) There is another big assumption that, big debt loads on every level, with no end in sight, and all, America will just go on smoothly, financially speaking. Peak Stupidity does not agree. To relate the situation to one of our favorite movies, we've long ago run out of burrito coverings. We can't cover all this in a post, but let's just imagine what the Fed Gov might do when the budget looks REALLY grim (say, 50% of yearly revenue goes straight to interest payments).

"Means testing", "austerity", "screw those rich bastards", you'll hear it all. This is why I don't count on getting all or even ANY of that sweet, sweet, SS cash myself. Maybe the earliest age for payout will go up. (Kind of an assumption (3) really.) There may be a formula - take a percentage of your assets and subtract it off your,... well, first go to form 1911-B and put this value on line 5... holey burrito coverings, the paperwork may be the worst of it!

These assumptions, not considered by those who either can't see ahead or have grown up in 1950s style America and just can't change, make any nicely calculated SS financial planning a load of garbage.

With our disclaimer first by the PS Legal Dept. that whatever happens based on our advice, you can't even find us, haha!... let me suggest our own optimum application date Social Security plan based on GOOD assumptions. First day they'll let you, go on, take the money and run!

frameborder="0" allowFullScreen>

* See also Part 2.

** What about compounding? Remember, in my own calculations, I've always backed out yearly averages based on compounding.

*** I went to the hated AARP for numbers - the average I got from their table, for 1991 through 2025 is 2.7%. Without the Brandon years, so ending in '21, and starting in the mid-'90s (1995) to better match most of my point-to-point calculations done here, it comes out to 2.2%.

**** Ooops, looks like you've got to subscribe now.

********************************

[UPDATED 10/01:] Added "Planning" to the title. Too much... time on my hands ...

********************************

Comments:

Moderator

Thursday - October 2nd 2025 8:16PM MST

PS: "Motorcycles shotguns and bicycles--" I dropped the motorcycling, but I like the other two. Fair enough.

Possumman

Wednesday - October 1st 2025 3:40PM MST

PS. Motorcycles shotguns and bicycles--- still cheaper than boats and airplanes and they don't need a slip or a hanger, so I'm good!

Moderator

Wednesday - October 1st 2025 10:41AM MST

PS: Possumman, it sounds like you've got your financial shit together. Now, get a boat or an airplane, and see what happens. ;-}

I would imagine the readers of this blog that stay for more than 30 seconds then WTF?! are similarly conservative in this way.

I would imagine the readers of this blog that stay for more than 30 seconds then WTF?! are similarly conservative in this way.

Moderator

Wednesday - October 1st 2025 10:39AM MST

PS: Alarmist, I did know that spelling, but I should have at least written bow-koo, to match the pronunciation. These stock option were a no-lose deal, unless you were really stupid. You could exercise them or not, and no other trading was necessary.

There's a lot of weird business with the high-level people and their dealings with the company stock. I know the yahoo finance site used to have a place where you could look up these people's trades.

Oh, I didn't just mean actuarily reduced, by inflation, but that the SS checks are lower (nominally) through all the years ahead if you start collecting earlier - or you start at 67, and they are higher nominally than if you'd started at 65. (You probably do know this, but I wanted to make it clear.) Then, expected actual inflation above COLA and further Government interference/screwage with the plan is another thing.

There's a lot of weird business with the high-level people and their dealings with the company stock. I know the yahoo finance site used to have a place where you could look up these people's trades.

Oh, I didn't just mean actuarily reduced, by inflation, but that the SS checks are lower (nominally) through all the years ahead if you start collecting earlier - or you start at 67, and they are higher nominally than if you'd started at 65. (You probably do know this, but I wanted to make it clear.) Then, expected actual inflation above COLA and further Government interference/screwage with the plan is another thing.

Possumman

Wednesday - October 1st 2025 8:30AM MST

PS We live pretty austerely --house paid-kids gone-don't own a boat or plane-waited til 65 to pull the plug on my job that was irritating me more and more every year (great job if you didnt have to deal with idiot employees and nutso customers) SS and small pension pretty much pays our day to day expenses and now 6 years later just watching our untouched 401ks grow and brokerage account beat the market quarter after quarter-have great advisor --may buy a new car in next year or 2 but so far SS pays for pretty much everything---life is good so far---if SS failed tomorrow we would still be fine---you gotta plan ahead

The Alarmist

Wednesday - October 1st 2025 7:45AM MST

PS

Beaucoup.

ESOP actually stands for Employee Stock Ownership Plan. There may be options in the mix, but the idea was to get employees to buy shares. I once had a deal where I got an option for each share I purchased to exercise and buy yet another share at the same price, which was nice if you had shares that had the potential to actually rise. The point is that I had a choice to participate or not.

That is in stark contrast to the deals I got later in my career, where a huge chunk of my bonuses was paid in restricted stock and options to “align my interests to those of the shareholders.” Which was kind of funny, because if the share price doesn’t go up, the companies that do this come under pressure to reprice the options and sweeten the restricted shares to stem the loss of key employees. Funny how that works.

Yep, you can start drawing SS at 62, and the best bet is to do it even though the amount will be “actuarially reduced” because the COLA adjustment is BS. Get the money now, while you can still spend it. As I tell Mrs. Alarmist, “financial planning” goes out the window when the system collapses, so it’s a good time to buy gold, guns, and ground.

🕉

Beaucoup.

ESOP actually stands for Employee Stock Ownership Plan. There may be options in the mix, but the idea was to get employees to buy shares. I once had a deal where I got an option for each share I purchased to exercise and buy yet another share at the same price, which was nice if you had shares that had the potential to actually rise. The point is that I had a choice to participate or not.

That is in stark contrast to the deals I got later in my career, where a huge chunk of my bonuses was paid in restricted stock and options to “align my interests to those of the shareholders.” Which was kind of funny, because if the share price doesn’t go up, the companies that do this come under pressure to reprice the options and sweeten the restricted shares to stem the loss of key employees. Funny how that works.

Yep, you can start drawing SS at 62, and the best bet is to do it even though the amount will be “actuarially reduced” because the COLA adjustment is BS. Get the money now, while you can still spend it. As I tell Mrs. Alarmist, “financial planning” goes out the window when the system collapses, so it’s a good time to buy gold, guns, and ground.

🕉

Moderator

Wednesday - October 1st 2025 5:45AM MST

PS: Good morning, M. The word "cuts" is often purposely used in this wrong way too. "Yeah, our budget was set to rise 5.5% next fiscal year. We got it cut back to ("a rise of", the won't even say) 3.2%. Deep cuts!! That's a 42% cut, people. Austerity!"

I also think of the word "austerity" as a Euro/Latin American Socialist/Welfare State thing. To be honest, "We're going to be doling out less of your money to you next fiscal year. Tough times..."

Now you reminded me of that long-to-come post on deflation. I still have the WSJ newspaper clipping both right near me but also scanned in.

I also think of the word "austerity" as a Euro/Latin American Socialist/Welfare State thing. To be honest, "We're going to be doling out less of your money to you next fiscal year. Tough times..."

Now you reminded me of that long-to-come post on deflation. I still have the WSJ newspaper clipping both right near me but also scanned in.

M

Wednesday - October 1st 2025 3:30AM MST

PS

"Austerity". The term is being thrown around now, though it's not being used correctly.

As it's being used now, it's a reduction in the asked for increase for next year. But that increase is on top of the automatic increase that departments get anyway.

To cover inflation. That the government is causing.

Yes, the government is causing it. It increases the money supply more than the increase in goods and services.

Admittedly, the opposite case of deflation would cause different problems. People would be reluctant to spend since their money would buy more goods later.

We haven't seen much of that. Deflation has mostly occurred in electronics, but that's been covered up by a number of ways of coping. See Apple for a recent example.

Back on topic. Actual "austerity" would mean an actual reduction in budget for next year, including removing that automatic increase. It's never yet happened as far as I know.

"Austerity". The term is being thrown around now, though it's not being used correctly.

As it's being used now, it's a reduction in the asked for increase for next year. But that increase is on top of the automatic increase that departments get anyway.

To cover inflation. That the government is causing.

Yes, the government is causing it. It increases the money supply more than the increase in goods and services.

Admittedly, the opposite case of deflation would cause different problems. People would be reluctant to spend since their money would buy more goods later.

We haven't seen much of that. Deflation has mostly occurred in electronics, but that's been covered up by a number of ways of coping. See Apple for a recent example.

Back on topic. Actual "austerity" would mean an actual reduction in budget for next year, including removing that automatic increase. It's never yet happened as far as I know.