Posted On: Thursday - February 14th 2019 12:42PM MST

In Topics: Trump Economics US Feral Government Taxes

Yep, Peak Stupidity does movie reviews, with no background in "film", book reviews of books that we don't have on hand, and now, reviews of IRS tax forms! Too much excitement? Too soon? (Before you can plead ignorance for this year's

Changes made by Congress a year ago last Christmas, as pushed for and signed by the Trump administration, were discussed at that time in Merry Christmas from

For a family business in which itemized deductions formerly just had to top $12,000 to start to matter, this new deal is a bad deal.

That was a recap. What I noticed and had not mentioned in that > year-ago post is that the simple child credit*, not childcare, etc, but just an amount PER CHILD, has gone up from $1,000 per kid to $2,000. That (see the footnote*) means the extra thousand per, is equivalent to a $4,500 or so deduction, so I will recant my statement about more kids being a worse deal. This extra amount overrides that loss of an exemption by just a tad. (The changes then, are just about a wash there no matter what the number of kids, and that $12,000 additional S.D. minus $~ $8,000 for 2 parents gives a $4,000 gain in deductions - say, $900 off the bottom line.) Also, this credit can be used for a family making more money than was the case in 2017.

Peak Stupidity does not claim to be a tax-accounting site, but still we apologize if the reader has held off having kids due to this slight oversight. As they say on youtube, "We own NOTHING! Don't sue! There's no point!" [Thank you! - PS Legal Department spokesman Dewey Cheatham.]

Keep in mind that the rates in tax brackets itself are lower at the middle class level by a few percentage points meaning 10% or so, which is not insignificant. (They are a tiny bit higher at the lower levels, as a 10% rate on income up to $18,000** (ADJUSTED income, i.e. after deductions) is now a 10% on up to $9,500, then 12% on up to $19,000.) Those who say that bill was another deal favoring the corporate and rich-man's world are wrong. It may be, I mean, but it helps the small guy enough to matter.

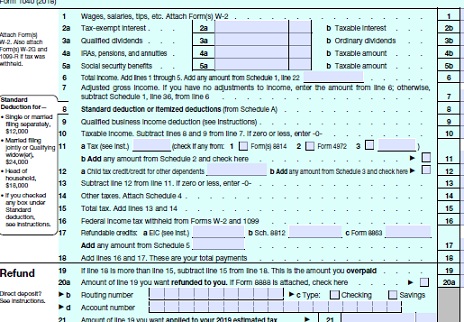

Now, here are a couple of points on the simplification: First, I don't see how anyone can really see this stuff without LOOKING AT THE FORMS themselves. No, Turbotax, etc, can do a fine job, and one can experiment with different scenarios, and your accountant can try to explain what's going on, as if you care (you just want the tax at a local minimum!) However, that all is no substitute for seeing the boxes and numbers in front of you.

This relates to the 2nd point, as, see that form up top? Yes, that is the whole 2018 1040 (not "-A", or "EZ", mind you), which has always been 2 pages. I suppose some stuff could have just been shifted, but possibly a lot has been eliminated. Good. Was that not Ronald Reagan's big quest? He said it should be on a postcard, and yes, he probably did make the joke that it would simply say:

a) How much did you make last year? ___________Man, I miss old Ronnie!

b) Send it in.

Are these new tax rules really a simplification to get rid of all those loopholes that the corps and the richies have got accountants and lawyers for? Seriously? No, that'll never happen until we scrap the whole damn deal. Ronnie Reagan would completely agree with Peak Stupidity, of that I have no doubt.

New 1040 out. Bon appetite, boys!

* A credit comes straight off the taxes, off the bottom line, the tax to be paid, that is. A deduction comes off the top line, the wages/interest(hahahaa!), so is worth much less. If one's income is such that his marginal rate is the new 3-points-lower 22%, the case for most of the middle-class, then a credit is worth ~ 4 1/2 times as much as a deduction.

** I've used the married-filing-jointly numbers

Comments: